Texas Instruments BA II Plus Professional Financial Calculator

Description

Texas Instruments BA II Plus Professional Financial Calculator

NOTE: Perlu diperhatikan bahwa, proses pengisisan daya HANYA direkomendasikan menggunakan perangkat komputer (pc) dan laptop saja. Kami TIDAK merekomendasikan proses pengisian daya menggunakan adaptor charger, karena voltase dari adaptor yang besar mampu merusak komponen baterai dalam kalkulator. KERUSAKAN KALKULATOR KARENA KELALAIAN DALAM PENGISIAN DAYA TIDAK ADA GARANSI DAN KOMPLAIN TIDAK AKAN KAMI RESPON!!

NEW PRODUCT & 100% ORIGINAL TEXAS INSTRUMENTS

Key features :

- Net Future Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback

- Discount Payback

- Time-Value-of-Money (TVM)

- Accrued interest

- Amortization

- Cost-Sell-Margin

- Depreciation

Exam acceptance :

- The BA II Plus Professional calculator is approved for use on the following professional exams:

Chartered Financial Analyst* exam

- GARP Financial Risk Manager (FRM)† exam

Feature highlights :

- Calculate IRR, MIRR, NPV and NFV for cash-flow analysis

Store up to 32 uneven cash flows with up to four-digit frequencies and edit inputs to analyze the impact of changes in variables.

- Time-value-of-money and amortization

Quickly solve calculations for annuities, loans, mortgages, leases and savings, and easily generate amortization schedules.

- Depreciation schedules

Choose from six methods for calculating depreciation, book value and remaining depreciable amount.

- Interest rate conversions

Convert between annual (nominal) and effective interest rates.

- One- and two-variable statistics

List-based and editable; four regression options: linear, logarithmic, exponential and power.

The BA II Plus Professional is ideal for these courses:

- Finance

- Accounting

- Economics

- Investment

- Statistics

- Other business classes

Built-in functionality :

- 10-Digit Display

- 10-User Memory

- Solves time-value-of-money calculations such as annuities, mortgages, leases, savings and more

- Generates amortization schedules

- Performs cash-flow analysis for up to 32 uneven cash flows with up to four-digit frequencies; computes Net Present Value (NPV) and Internal Rate of Return (IRR)

- Net Future Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback and Discounted Payback

- Choose from two day-count methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call

- Six methods for calculating depreciation, book value, and remaining depreciable amount: SL, SYD, DB, DB with SL cross-over, SLF and DBF

- Depreciation Schedules

- Bond prices and yield to call or maturity

- Prompted display guides you through financial calculations showing current variable and label

- BGN/END payment setting

- Partial years

- List-based one- and two-variable statistics with four regression options: linear, logarithmic, exponential and power

- Math functions include trigonometric calculations, natural logarithms and powers

NOTE: Perlu diperhatikan bahwa, proses pengisisan daya HANYA direkomendasikan menggunakan perangkat komputer (pc) dan laptop saja. Kami TIDAK merekomendasikan proses pengisian daya menggunakan adaptor charger, karena voltase dari adaptor yang besar mampu merusak komponen baterai dalam kalkulator. KERUSAKAN KALKULATOR KARENA KELALAIAN DALAM PENGISIAN DAYA TIDAK ADA GARANSI DAN KOMPLAIN TIDAK AKAN KAMI RESPON!!

NEW PRODUCT & 100% ORIGINAL TEXAS INSTRUMENTS

Key features :

- Net Future Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback

- Discount Payback

- Time-Value-of-Money (TVM)

- Accrued interest

- Amortization

- Cost-Sell-Margin

- Depreciation

Exam acceptance :

- The BA II Plus Professional calculator is approved for use on the following professional exams:

Chartered Financial Analyst* exam

- GARP Financial Risk Manager (FRM)† exam

Feature highlights :

- Calculate IRR, MIRR, NPV and NFV for cash-flow analysis

Store up to 32 uneven cash flows with up to four-digit frequencies and edit inputs to analyze the impact of changes in variables.

- Time-value-of-money and amortization

Quickly solve calculations for annuities, loans, mortgages, leases and savings, and easily generate amortization schedules.

- Depreciation schedules

Choose from six methods for calculating depreciation, book value and remaining depreciable amount.

- Interest rate conversions

Convert between annual (nominal) and effective interest rates.

- One- and two-variable statistics

List-based and editable; four regression options: linear, logarithmic, exponential and power.

The BA II Plus Professional is ideal for these courses:

- Finance

- Accounting

- Economics

- Investment

- Statistics

- Other business classes

Built-in functionality :

- 10-Digit Display

- 10-User Memory

- Solves time-value-of-money calculations such as annuities, mortgages, leases, savings and more

- Generates amortization schedules

- Performs cash-flow analysis for up to 32 uneven cash flows with up to four-digit frequencies; computes Net Present Value (NPV) and Internal Rate of Return (IRR)

- Net Future Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback and Discounted Payback

- Choose from two day-count methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call

- Six methods for calculating depreciation, book value, and remaining depreciable amount: SL, SYD, DB, DB with SL cross-over, SLF and DBF

- Depreciation Schedules

- Bond prices and yield to call or maturity

- Prompted display guides you through financial calculations showing current variable and label

- BGN/END payment setting

- Partial years

- List-based one- and two-variable statistics with four regression options: linear, logarithmic, exponential and power

- Math functions include trigonometric calculations, natural logarithms and powers

Price history chart & currency exchange rate

Customers also viewed

$31.20

Makita DHP487 Отвертка Аккумуляторная ударная дрель 18 В Электрический бесщеточный двигатель с регулируемой скоростью Ударные электроинструменты Электродрель

aliexpress.ru

$15.72

XZZ Инструменты для ремонта мобильных телефонов, свободный нагрев, разделитель ЖК-экрана, без подогрева, разделительное приспособление, XZZ X3

aliexpress.ru

$16.49

Серебряная керамическая чашка для влюбленных, чашка для послеобеденного чая и кофе, Женская Роскошная чашка для домашнего завтрака, сока, молока, напитков, креативная офисная чашка для чая

aliexpress.ru

$80.00

High quality Brand New ML239298 5WK96788 Nitrogen Oxide Sensor Nox Sensor for Mitsubishi Fuso Canter Lambda

aliexpress.ru

$90.62

Black Matte Zipper Leather Boots Thin High Heel Pointed Toe Fashion Sexy Cool 2024 Winter Big Size Woman Shoes Zapatillas Mujer

aliexpress.com

$632.47

RACEPRO NEW ARRIVAL Motorcycle Accessories Carbon Fiber Front Fender For Harley Davidson Low Rider S FXLRS 2020 2021 2022 2023

aliexpress.com

$1,304.83

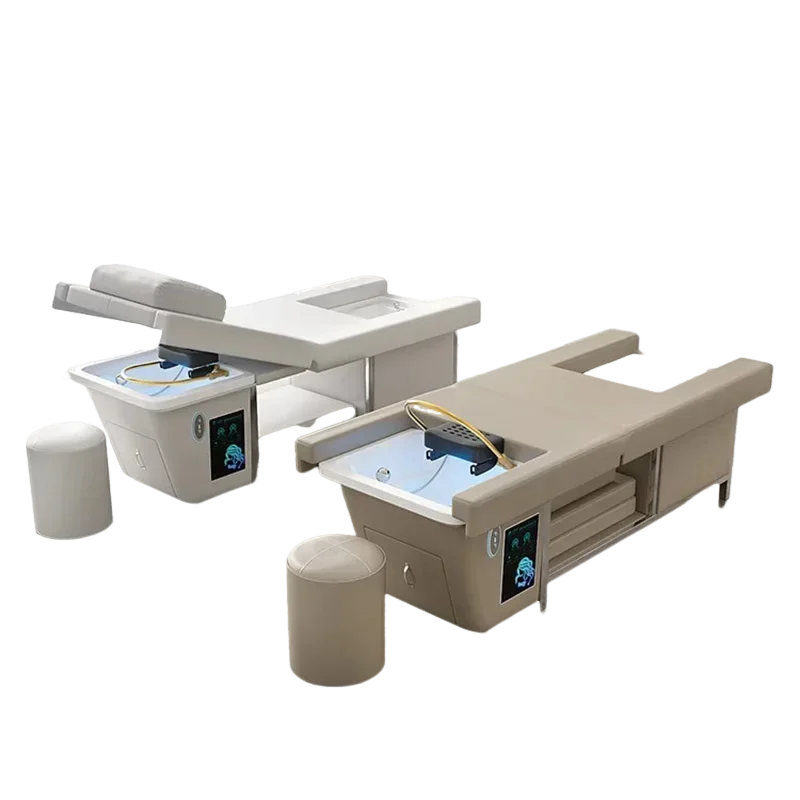

Shower Head Spa Shampo Chair Move Adjust Portable Sink Hair Wash Bed Massage Foot Shampouineuse Salon Equipment

aliexpress.com

$1,617.00

Commercial Industrial Sausage Filling Machine Sausage Stuffer With Restaurant

aliexpress.com

$17.21

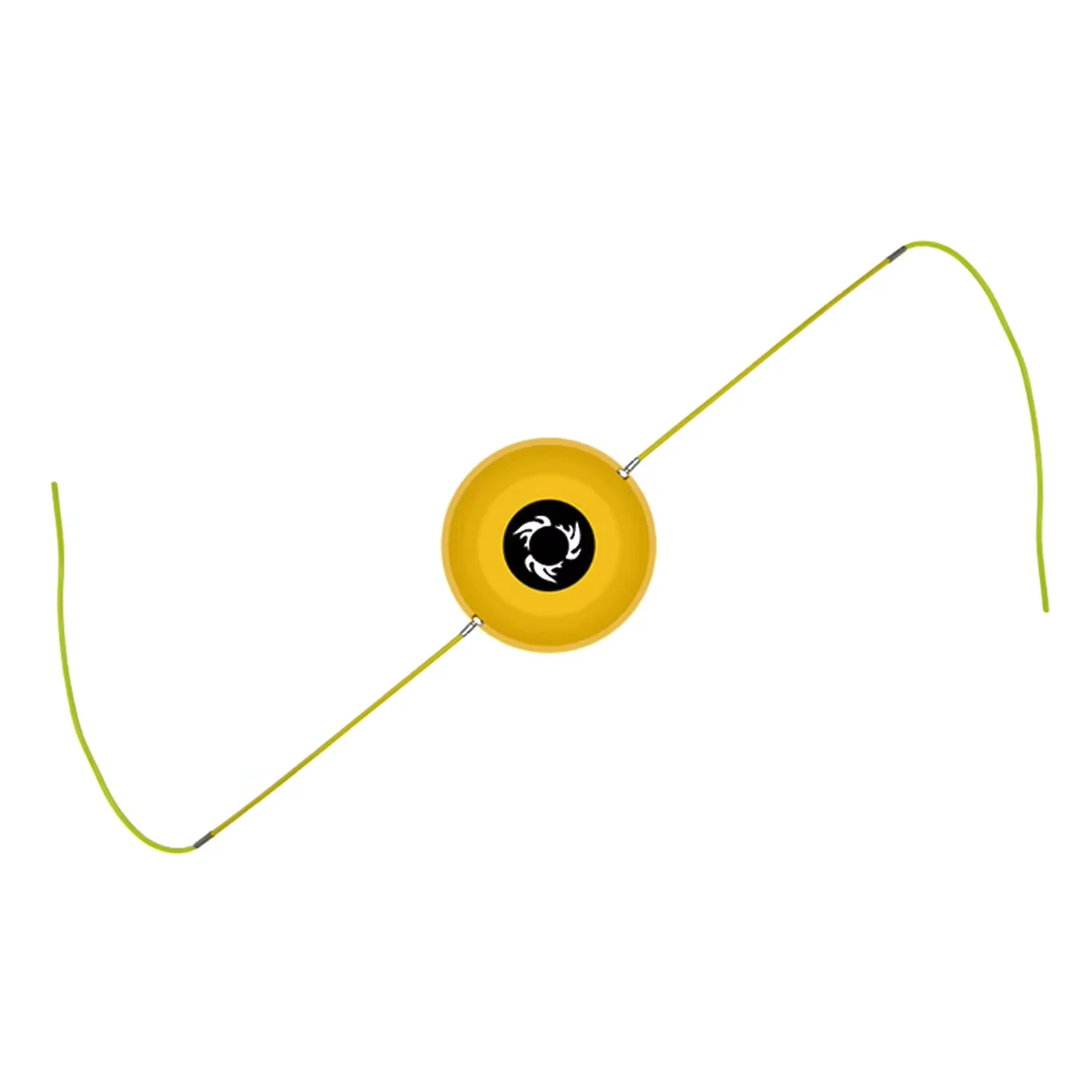

Intelligent Automatic Rope Skipping Machine Multi Person Training Jump Rope Fitness Equipment Full Body Excercising Jumprope

aliexpress.com

$3.45

Fast Response GM Intake Air Temperature Sensor IAT/MAT/ACT Kit For Chevrolet GMC Auto Accessories 25036751 25037225

aliexpress.com

$6.17

Hospitalized Pajamas Cotton Long Sleeve Sleepwear Unisex Soft Patient Adult Stripe Design Comfortable Hospital Clothes

aliexpress.com

$26.31

Tennis Suit Sports Fitness Backless Sexy Breathable Golf Badminton Outdoor Running Casual Bra Nude Two-piece Yoga Set for Women

aliexpress.com

$1.24

Blackout Roller Blinds for Kitchen Windows Curtains with Suction Cups Sun Blocker Cover against Baby

aliexpress.com

$16.23

Waffle Baby Clothes Set Autumn Kids Coats Pants Hat Suit Home Loungewear Casual Baby Outfit Children Boys Girls Clothing

aliexpress.com

$4.80

Противоскользящий силиконовый резиновый коврик для телефона X до 13ProMax, устойчивый к высоким температурам, вакуумная всасывающая подушка, инструмент для очистки экрана от клея

aliexpress.ru

$2.92

2022 NEW Big Wide for Men's Jewelry Bracelet Atmosphere Chain Classic Bracelet Gold Plated Chain Men's Gift Bracelet

aliexpress.com

$25.00

Для моего сына, стальные спортивные водонепроницаемые мужские часы, люксовый бренд, для отдыха, мужские наручные часы, календарь, 24 часа, Dail, ...

aliexpress.ru

$12.91

Лидер продаж, натуральный порошок экстракта Окра 10:1, косметическое сырье, защита зрения

aliexpress.ru

$9.86

Disney Minnie Mouse Fall Bodycon Dresses for Women Slim Sexy 2021 Printing Long Sleeve Kawaii Robe Femme Black Brown Midi Dress

aliexpress.ru

$37.69

High-end Cheongsam Autumn and Winter 2021 New Olympic Velvet Long Temperament Young Slim Improved Dress

aliexpress.ru

$19.64

2021 Spring and Summer New Style Breathable Fly Woven Athletic Shoes Korean-style Versatile WOMEN'S Shoes Women Sneakers

aliexpress.ru

$8.85

22PCS Eye Makeup Brush Set Pink Beauty Tools Foundation Powder Eyeshadow Cosmetics Beauty Tools Maquiagem

aliexpress.ru

$4.38

Household Cotton Linen Place Mat Placemats For Table Heat-insulated Washable Pads Japanese Style Placemats Table Decoration

aliexpress.ru

$9.97

Скинали на кухню Zatarga «Клубничный пудинг сладости» 600х2500 мм виниловая 3Д наклейка кухонный фартук

prom.ua

$8.86

CBAFU summer tops women summer Tshirt vintage character cartoon print T-Shirt women tee shirt femme casual tops P065

aliexpress.com$0.06

SET-Box Kardus Model Pizza Box Diecut 9x7x2 cm Single Craft Coklat Natural Kraft Praktis Kokoh untuk Usaha Kuliner Take Away Hadia Aksesoris Pakaian

shopee.co.id

$25.80

Beer Drinking Barrel 3d Printed 16oz Glass Can Soda Cup With Lid&Straw Coffee Glass Holiday Season Gift Party Drinkare

aliexpress.com

$21.63

Elegant Sweet Lace Patchwork White Long Sleeve V-Neck Girl T-Shirts For Women Casual Fashion Slim Fit Sexy Tees Thin Tops

aliexpress.com